The European Patent Office (EPO) recently published its traditional annual patent index showing European patent statistics for 2024. It is interesting to make an exhaustive analysis of these data, which are an indisputable indicator of the state and evolution of innovative activity, not only from Europe, but from the rest of the world. These statistics allow us to see in which countries a larger volume of European patents is being generated and how European countries, and within them of course Spain, are positioned in terms of technological sovereignty in Europe, also identifying which technical fields are booming.

Thus, analysing the published data, we see, firstly, that the overall number of applications for European patents (EPs) filed during the past year at the EPO has remained practically unchanged with respect to the previous year, showing a negligible drop of 0.1%. If we look only at the Member States of the European Patent Convention (39 states), we see a slight increase (0.3%) in the number of EP applications from these states.

With regard to the country of origin of the inventions (understood as the country of residence of the first applicant appearing on the patent application), there was a notable presence of the USA (24%) in European applications filed in 2024, followed by Germany (12.6%) and then Asian countries, specifically Japan (10.6%), China (10.1%) and Korea (6.6%). Regarding the latter, it should be noted that Korea has been the country with the highest growth rate compared to previous years, even outpacing China’s growth rate. Among the European countries that have filed the most EP applications are France, Switzerland, the Netherlands, England, Sweden and Italy, all of them behind Germany.

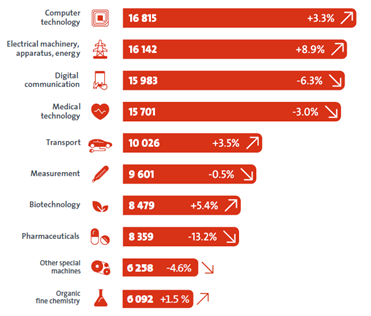

It is not surprising to note, as we have seen in recent years, that the main applicants for European patents worldwide during 2024 have been technology and telecommunications companies, in particular, Samsung (Korea), Huawei (China), LG (Korea), Qualcomm (USA), RTX (USA), Siemens (Germany), BASF (Germany), Ericsson (Sweden) and Sony (Japan). Accordingly, during 2024, inventions related to ICT (what is known in patent jargon as Computer Implemented Inventions (CII)) and related to artificial intelligence have undergone a notable increase, climbing two places in the ranking of technological fields in which the most patents are filed and placing them at number 1 on the list. Other technical fields, such as electrical machinery and energy, transport, biotechnology and organic chemistry, have also experienced an increase during 2024. However, other sectors such as digital communication, medical technology and the pharmaceutical sector have suffered a decline:

The data published by the EPO also shows that 71% of European applications filed during 2024 belong to large companies, 22% to SMEs and individual inventors and the remaining 7% to universities and public research centres. This data contrasts with the data for Spanish applicants, where the opposite is true: most patent applications are filed by public centres and universities. Therefore, while in Spain most knowledge and, therefore, innovation, is generated in public universities and research centres, in the rest of Europe, and in the world, it is the large companies that bear the brunt of innovation, or at least this is the reading that could be made if only patents filed are taken into account as an indicator of countries’ innovation.

As for unitary patents, 25.6% of the EPs granted during 2024 opted for this route and if we cross-reference this data with the unitary patent statistics, also published by the EPO, we see that most of them (61.7%) are filed by large companies such as Siemens, Johnson & Johnson or Samsung, so it seems that it is an attractive option for these types of companies that incorporate this modality into their patent protection strategies after weighing up the pros and cons of this system. As for the countries of origin of inventions that opt for the unitary patent route, we find mainly European states and the USA which, through this patent modality, seems to have begun to see Europe as a unified market, similar to its own, as far as patents are concerned, and to value this fact positively.

As for Spain, in 2024, 2,192 EP applications of Spanish origin were filed (63 more than last year, that is, 3% more), which represented 1.1% of the total EPs filed during 2024. This data contrasts with the 2024 statistics from the SPTO, which show a slight decrease in the number of Spanish EP applications filed with the Spanish office (SPTO), as we reported at the time in our blog. Therefore, the conclusion could be that many Spanish applicants file directly with the EPO instead of the SPTO.

The technical area at the head of European applications of Spanish origin is the pharmaceutical sector (10.1%), followed by biotechnology and medical technology (7.4% in both cases) and transport (6.8%), so innovation in health sciences seems to be standing out with respect to other technological fields in our country.

The Spanish National Research Council (Consejo Superior de Investigaciones Científicas or CSIC) continued to be the leading Spanish applicant for European patents in 2024, having filed 68 applications during the year. Other Spanish applicants at the top of the list of European patent applications generated in Spain are AMADEUS, Fundación Tecnalia, Autotech Engineering, Telefónica, Horse Powertrain Solutions, Ficosa, Multiverse Computing, the Polytechnic University of Catalonia and the University of the Basque Country. It is interesting to note that in this ranking of the main Spanish applicants, various private sector companies have entered the field in recent years, which means that innovative activity and the commitment to intellectual property associated with it is increasingly important to them.

On the other hand, Spain still ranks 24th among the countries of the world in terms of the number of EP applications filed per million inhabitants. We are therefore still far from the top positions and in this sense we have some way to go, but the statistics are encouraging as the trend is improving every year. Furthermore, a data in which Spain is very well positioned is the number of EP patent applications in which women appear among the inventors. In this sense, our country is number one in the ranking of European countries that cite women as inventors in their European applications.

Given this scenario, we can say that there have been two major challenges in Spain for years: the first is to catch up with other European countries in terms of the volume of patents filed, to move up the ranking of European countries that patent the most and, with this, to gradually gain ground in terms of technological sovereignty and competitiveness in the European market.

Secondly, given that the main Spanish applicant for European patent applications continues to be, once again, a public institution, Spain faces an added challenge compared to other European countries, which is to have efficient, suitable and viable systems, resources and means to achieve an effective transfer of the technology associated with protected inventions to companies that have the capacity to exploit them in the market and that this ultimately results in a benefit for society.

If we analyse who the main patent applicants are in other European countries, such as Germany or France, we see that private companies appear at the top of the ranking, so the paradigm is different from that of our country. However, as we have said before, Spain is gradually changing this trend and the future of the competitiveness of our companies in the European framework is, therefore, hopeful.

Written by: Ana Herrera, Director of Patents, Technological Development and Innovation | European Patent Attorney.