“World Intangible Investment Highlights 2025”, the latest report by the World Intellectual Property Organization (WIPO), confirms a structural shift in the global economy: since 2008, investment in intangible assets, such as software, R&D, brands and data, has grown almost four times faster than investment in physical assets. The United States leads in absolute terms, with Sweden leading in relative intensity and India having the highest growth rate. This reflects a global momentum that consolidates the role of intangibles as a pillar of economic growth, productivity and international competitiveness.

Key evidence of a structural change

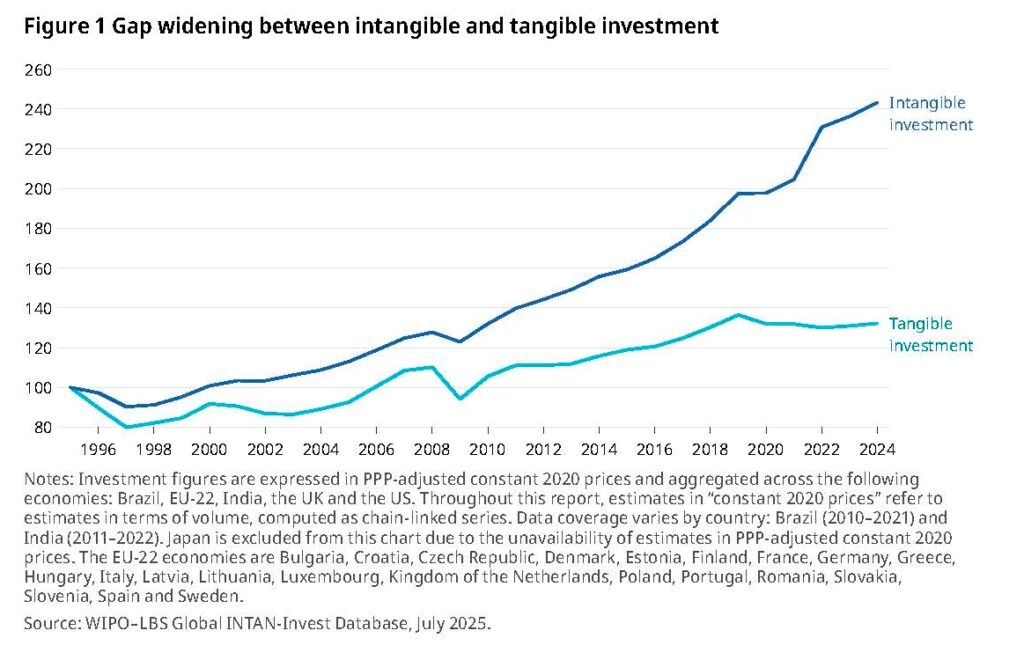

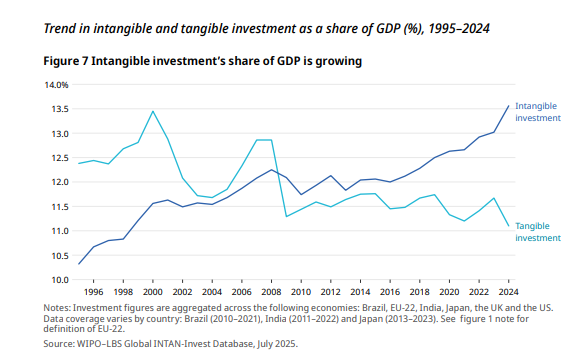

The WIPO report highlights that investment in intangible assets has not only far outpaced the growth of physical capital, but has also successfully cushioned the effects of the unfavourable economic context. Between 2020 and 2024, the 12% increase in investment in the countries analysed is almost entirely due to the expansion of intangible capital (23%), compared to the stagnation of tangible capital. This trend has increased the share of intangibles in global GDP, which rose from 10% in 1995 to 13.6% in 2024, far surpassing the share of tangibles (11%).

At the country level, leadership is shared. The United States continues to be the global leader in intangible asset investment, with more than USD 4.7 trillion in 2024, while Sweden leads the ranking in terms of relative investment accounted for GDP (16%). India, for its part, stands out as the economy with the highest annual growth in assets of this type, averaging nearly 7% between 2011 and 2022.

Some of the most dynamic intangible assets include software and databases, closely linked to the rise of artificial intelligence, followed by R&D, brands, and design. Organizational capital, which includes internal know-how and management capabilities, now accounts for 30% of the total intangible investment worldwide. This composition reflects how digital transformation, automation and AI are reshaping investment models, even in traditional sectors.

The report also emphasises that AI-driven investments are redefining the balance between what is tangible and what is intangible. While major North American technology companies lead the way in terms of physical infrastructure, sectors such as healthcare, education, and industry are moving toward an extensive reconfiguration based on software, data, talent, and organization.

Data from the 2025 WIPO report establish a clear conclusion: intangible assets are not simply a complement to physical capital, but the new driver of economic growth. In this context, proactive management of the intellectual property derived from these intangible assets emerges as a strategic obligation.

Thus, in a world where investment in these assets will continue to grow as stated in the report, organizations that commit to a robust intangible asset protection strategy as a lever for growth will be better prepared to capitalize on and transfer their investments in innovation, as well as avoid the risk of third-party infringement, strengthening their leadership in sectors that are increasingly competitive. For this reason, having a well-designed intellectual property strategy is now a real requirement for any organization that wishes to be competitive in a global market.